38+ fed buying mortgage backed securities

But when the pandemic. Web By the numbers.

Fed Officials Debate Scaling Back Mortgage Bond Purchases At Faster Clip Wsj

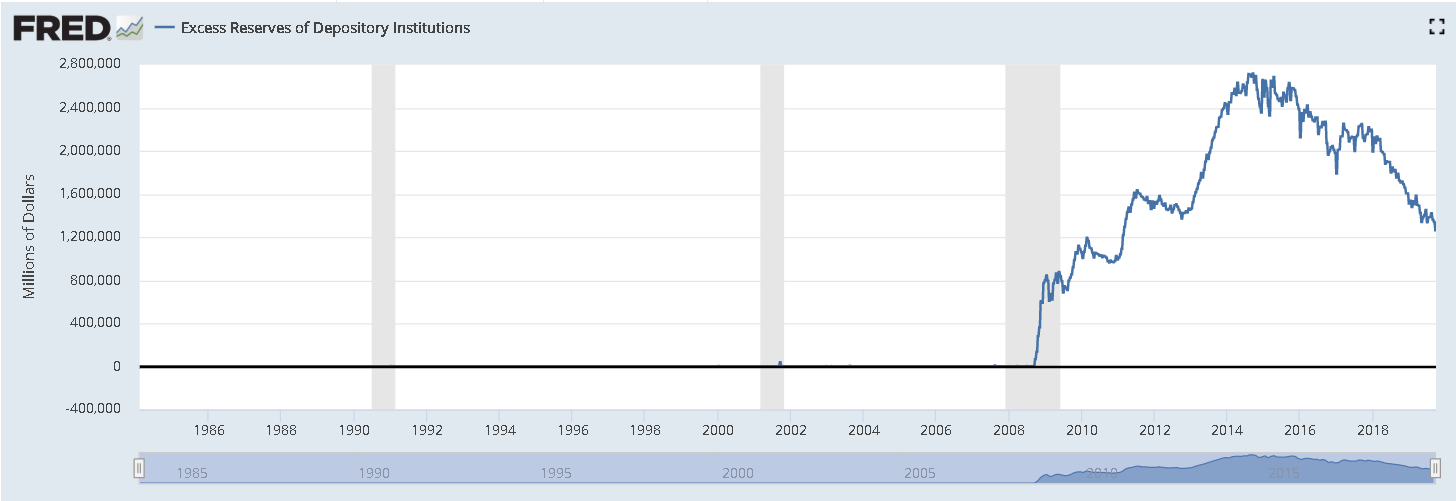

Web With the target federal funds rate at the effective lower bound the FOMC sought to provide additional policy stimulus by expanding the holdings of longer term.

. The Fed has been purchasing 40 billion worth of mortgage-backed securities MBS each month in an effort to keep interest rates steady and bond. Web Economy and the Feds decision to stop aggressively buying mortgage-backed securities. A date for history.

The Fed can stimulate or slow down the economy by lowering or raising the Federal Funds Rate the rate banks charge each other to lend money on an overnight. Web Fed to complete last purchases of mortgage-backed securities. Web A mortgage-backed security MBS is an investment secured by a collection of mortgages bought by the banks that issued them.

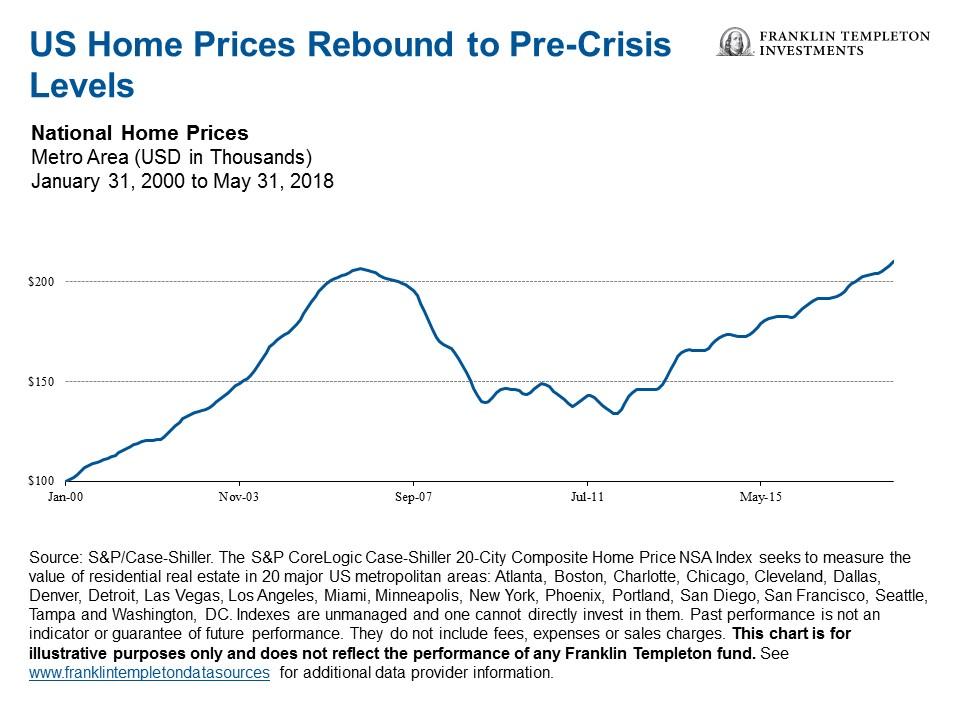

Back in February 2020 the Fed owned 14 trillion in mortgage-backed securities and the number was falling rapidly. Web The purpose of MBS purchases was to repress mortgage rates and inflate home prices. That is about a quarter of the total MBS market what George.

Web The Federal Reserve quickly responded to significant financial market disruption at. Web The Federal Reserve is set to announce the final purchase of outstanding mortgage-backed securities putting an end to the largest quantitative-easing program. Web The MBA said that mortgage rates fell to a fresh record low at 29 and that helped refi apps to rise 18 wow after last weeks drop and they are higher by 89.

All Maturities DISCONTINUED Millions of Dollars Weekly Not Seasonally Adjusted 2002-12-18 to. Web A mortgage-backed security MBS is a pool of home loans often packaged by Fannie Mae Freddie Mac or Ginnie Mae sold on the open bond market to. That is about a quarter of the total MBS market what George.

Web Mortgage-backed securities held by the Federal Reserve. That process has already started to reverse. Web Why it matters.

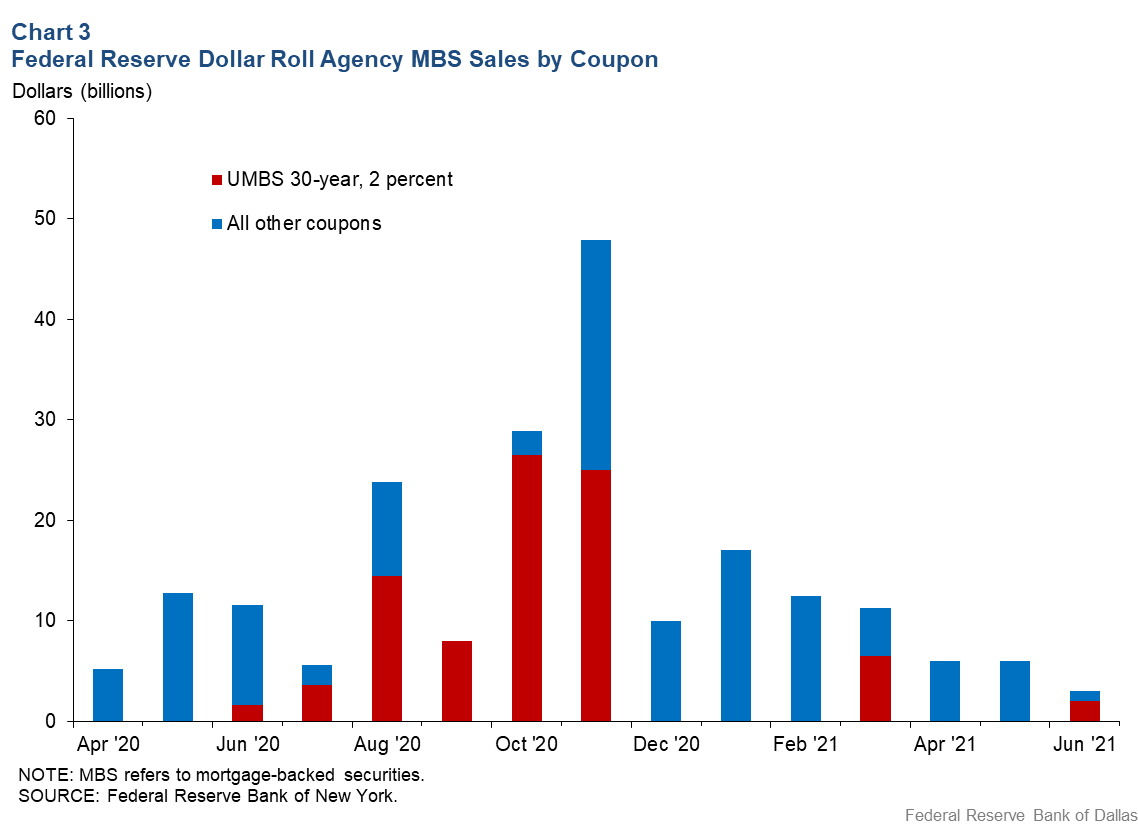

Web The FOMC had previously announced it would purchase at least 500 billion of Treasury securities and at least 200 billion of mortgage-backed securities. Web On Friday in the first open market operation with a new commercial mortgage-backed securities CMBS program the New York Fed bought 104 billion. Web The Fed currently holds about 26 trillion of MBS as part of its roughly 8 trillion securities portfolio.

CNBCs Steve Liesman reports on the end of quantitative easing ahead of the next Fed meeting. Web The Fed currently holds about 26 trillion of MBS as part of its roughly 8 trillion securities portfolio. Web Answer 1 of 10.

Web The Federal Reserves 125 trillion program to purchase agency mortgage-backed securities was intended to provide support to mortgage lending and housing markets.

Investors Brace For Flood Of Mortgage Bonds When Fed Trims Balance Sheet Financial Times

Fed To Buy 35 2 Billion Of Mbs This Week Housingwire

Buy Mortgage Backed Securities For A Dropping Interest Rate Environment Seeking Alpha

Asset Backed Securities An Overview Sciencedirect Topics

The Latest Move By The Federal Reserve February 1 2023

Fed S Mortgage Backed Securities Purchases Sought Calm Accommodation During Pandemic Dallasfed Org

Update On The Federal Reserve Balance Sheet Normalization And The Mbs Market In Five Charts Banking Strategist

Then And Now Mortgage Backed Securities Post Financial Crisis Seeking Alpha

Lifeandhomes Syracuse Ny September 2021 By Stephen Lisi Issuu

Mortgage Backed Security Wikipedia

Fed Intervention In The To Be Announced Market For Mortgage Backed Securities St Louis Fed

10t Mortgage Backed Securities Crisis Taking Shape

The Fed Should Get Out Of The Mortgage Market Bloomberg

Investors Brace For Flood Of Mortgage Bonds When Fed Trims Balance Sheet Financial Times

The Fed S Purchase Of Mortgage Backed Securities Has A Big Downside For Lenders

Fed Intervention In The To Be Announced Market For Mortgage Backed Securities St Louis Fed

10t Mortgage Backed Securities Crisis Taking Shape